stock option tax calculator ireland

You purchase 10 Irish shares in January 2022 at a cost of 500 each. Click here for more insights from Deloitte.

.png?width=1952&height=840&name=Add%20a%20subheading%20(2).png)

Tax On Share Options In Ireland How Stock Options Are Taxed In Ireland

Stock options There are a number of issues with the current taxation of stock options.

. The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment. Cost of Shares10000 shares 1 10000. No responsibility is taken by Deloitte for any errors or for any loss however occasioned to any person by reliance on this.

Stock options restricted stock restricted stock units performance shares stock appreciation rights and. Approved Profit Sharing Schemes allow an employer to give an employee shares in the company up to a maximum value of 12700 per year. Marginal tax rates currently up to 52 apply on the exercise of share options.

Click your cursor in the box Ticket price and when you find the ticket of your choice click on the ticket price and it will automatically be entered into the savings calculator box. Financing cost charged at overnight market rate. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

Example of Reduced Capital Gains Tax on Shares in Ireland. This calculator is designed for illustrative purposes only. If you sold all 500 shares then your total gain would be 2500.

The rules apply to payments between associated. If you did live. Emily made an Exercised Share Profit of 20000.

The Global Tax Guide explains the taxation of equity awards in 43 countries. USC is tax payable on an individuals total income. How to Calculate your RTSO1 Share Option Tax.

The first 1270 of gains made by any individual in a tax year are exempt from Capital Gains Tax and so the. Calculate Tax Clear Form. The problem is that there is literally no information in the Internet about how this activity would be taxed in.

The Capital Gains Tax accrued in Ireland for corporations and individuals is calculated using the following Capital Gains formula. In essence this means that the money is outside Ireland and if you. How to pay.

The new rules will deny deductions for such payments or in certain circumstances will subject them to tax in Ireland. A The net capital. In most cases the RSUs are held in a brokerage account outside Ireland.

Providing the scheme meets the required. An excellent online calculator for Corporation tax calculations in Ireland general companies banks financial institutions and non operating entities with 2022 Corporation tax rates. So if you made a 100000 gain on a property that was your private residence for 5 years and rented for an additional 5 the taxable gain would be 510 X 100000 50000.

The tax is due on the difference between the. Income Tax rates are currently 20 and 40. Amount you pay when you.

This is calculated as follows. You will only pay tax if the option price is less than the market value of the shares at the grant date. On the date of exercise the fair market value of the stock was 25 per share which is.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. The rate for the DEGIRO Trackers and Investment Funds Core selection is based on a Fair Use Policy. This places Ireland on the 8th place in the International.

Capital Gains Tax a x b 100 Where. The 30 day period includes the exercise date. In October 2022 they are worth 800 each.

This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the. EToro income will also be subject to Universal Social Charge USC. Hi everyone Im interested in starting to trade US stock options contracts.

You can make your payment using. 2022 2021 Income Tax Calculator TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. For more information see here.

Capital Gains Tax on RSUs and Non-Doms. Value of Shares10000 shares 3 30000. You must pay RTSO within 30 days of exercising the options.

Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete.

Stock Profit Average Down Calculator Apps On Google Play

How Bonuses Are Taxed Calculator The Turbotax Blog

1842 Is The Number Of Rooted Trees With 11 Vertices Carlsbad Carlsbad California Online Business Opportunities

![]()

Equity Release Calculator No Personal Details Required

How Cheap Accountants In Croydon Are Helping Small Business Grow Faster Accounting Accounting Jobs Accounting Services

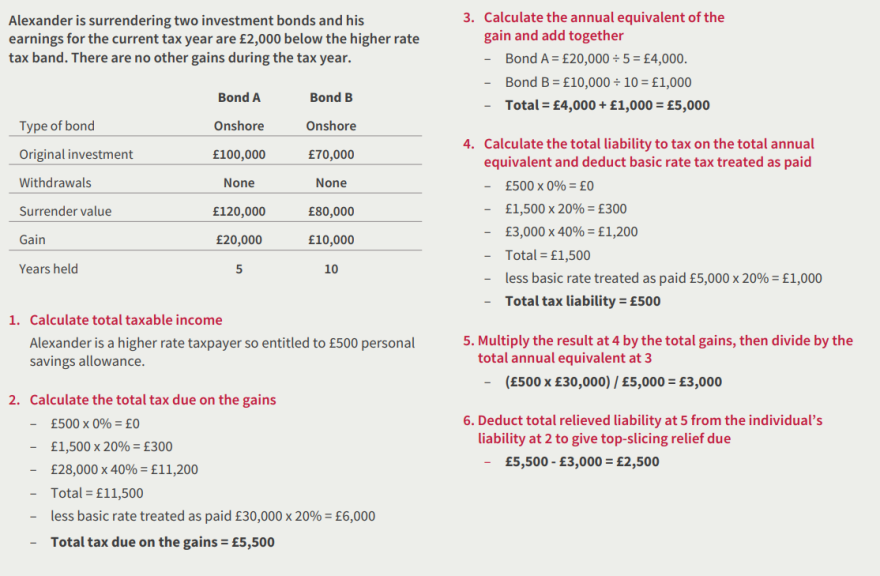

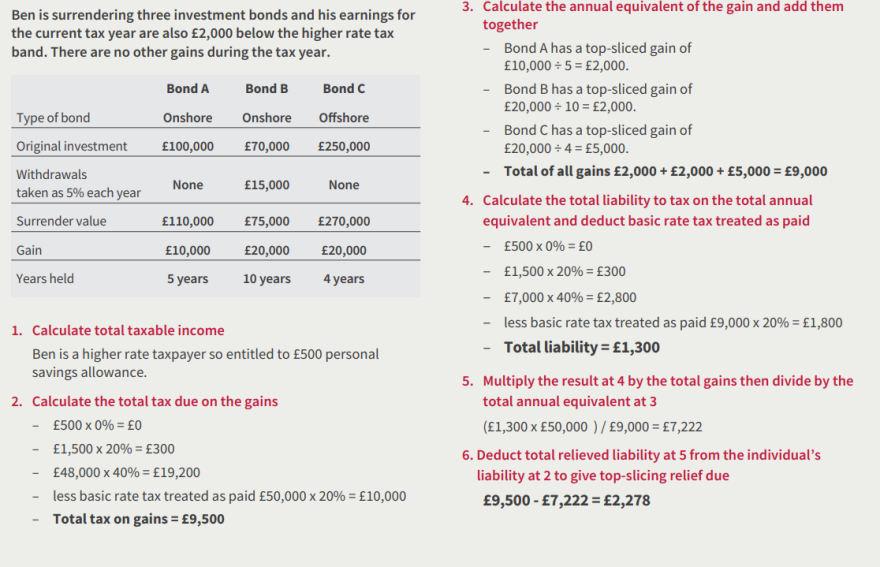

Calculating Multiple Chargeable Gains

Overtime Calculator How To Calculate Overtime Pay Breathe

![]()

Install Contractor Tax Calculator On Linux Snap Store

Capital Gains Tax On Shares In Ireland Money Guide Ireland

Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Debt Problem Repayment

Calculating Multiple Chargeable Gains

Agra Hotels Booking Discounted Agra Hotels Rates Luxury Hotels Agra Honeymoon Hotels Agra Low Budget Hotels In Honeymoon Hotels Hotel Rates Budget Hotel

I Wish To Love And Protect Our Future A Good Retirement Savings Plan Is Very Important Loveandprotec Mortgage Payoff Pay Off Mortgage Early Mortgage Loans

Free Photo Finances Saving Economy Concept Female Accountant Or Banker Use Calculator Business Loans Finance Saving Loan Company

Paylesstax 45 Minute Tax Return

How To Calculate Capital Gains Short Long Term Fy 2021 22

Difference Between Global Or Ihrm And Domestic Hrm Hrm Exam Employee Management Exam Hr Management