capital gains tax changes 2020

In the 2018 Budget former Chancellor Phillip Hammond announced a couple of changes to the capital gains tax CGT regime and reliefs available to owners of a residential property which was once their main residence. Capital Gains Tax changes April 2020 1.

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

For example the maximum credit amount is increased from 3618 to 3733 for workers with one child.

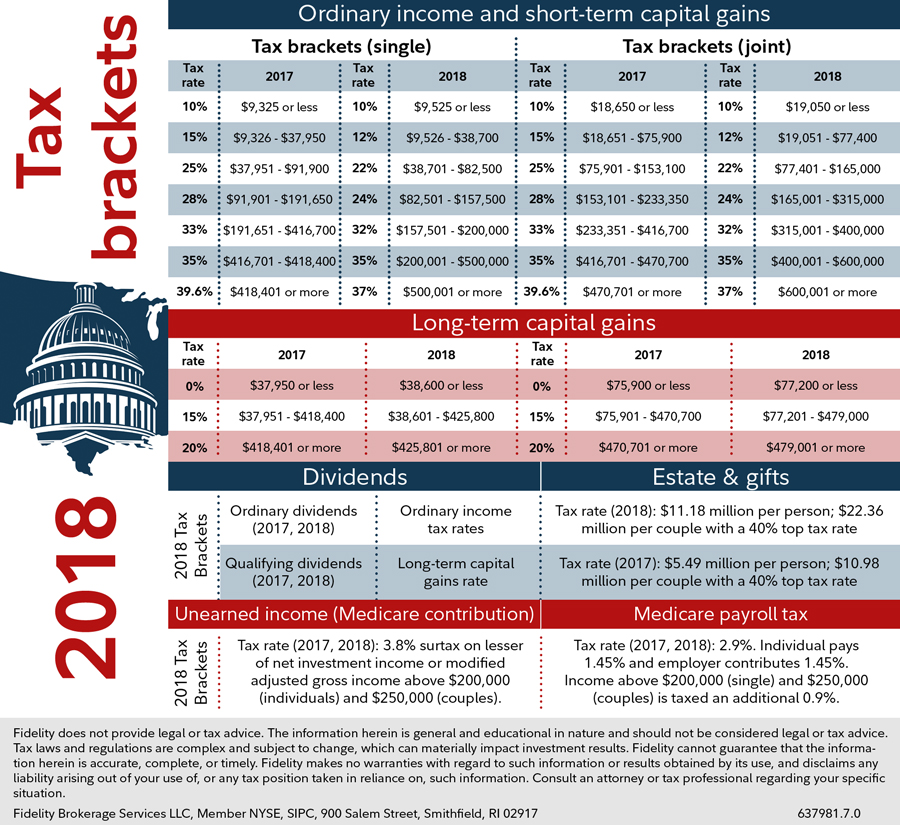

. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. You pay 1286.

Capital gains tax rates on most assets held for a year or less correspond to. HM Revenue Customs. SEE MORE What Are the Income Tax Brackets for 2021 vs.

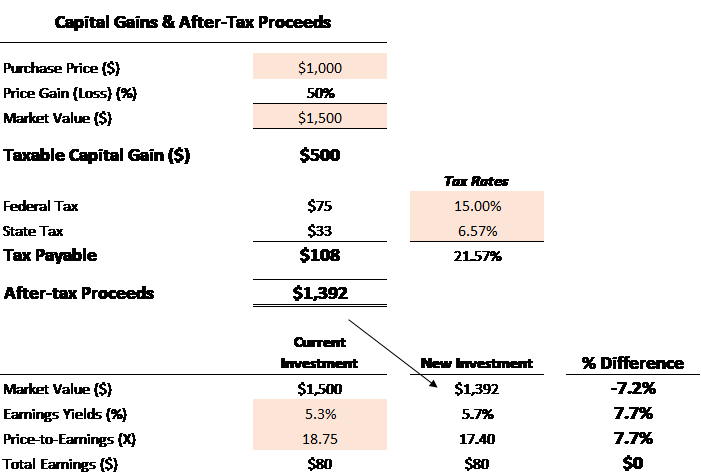

Long-term capital gains taxes are assessed if you sell investments. In 2018 the IRS condensed Form 1040 significantly completely revamping the. The tax rate on most net capital gain is no higher than 15 for most individuals.

President Biden is expected to include a capital gains tax increase for wealthy. In 2018 the IRS significantly reduced the Form 1040 completely revising the previous traditional version and introducing additional programs that transmit information to the Form 1040 although the IRS has not changed Form 1040. SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income.

Payable within 30 days. Capital gains tax CGT breakdown. Previously it was not necessary to report or pay CGT until you submitted your.

At the moment if the property that you are disposing of was once your main residence. The 2019 to 2020 tax year is the last year UK residents will be required to pay the Capital Gains Tax for the sale of properties as part of. That applies to both long- and short-term capital gains.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Bidens Plans to Increase Rates for Wealthy Americans. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0.

Long-term capital gains are usually subject to one of three tax rates. There are also several inflation-based adjustments that modify the EITC for the 2022 tax year. Hawaiis capital gains tax rate is 725.

You pay no CGT on the first 12300 that you make. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. The changes which are due to come into effect on 6th April 2020 will have an impact on the CGT liability at the time the property is sold.

The higher your. Tax rate Unmarried Married filing jointly Heads of household. What were the Capital Gains Tax changes.

Youll owe either 0 15 or 20. 500000 of capital gains on real. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower.

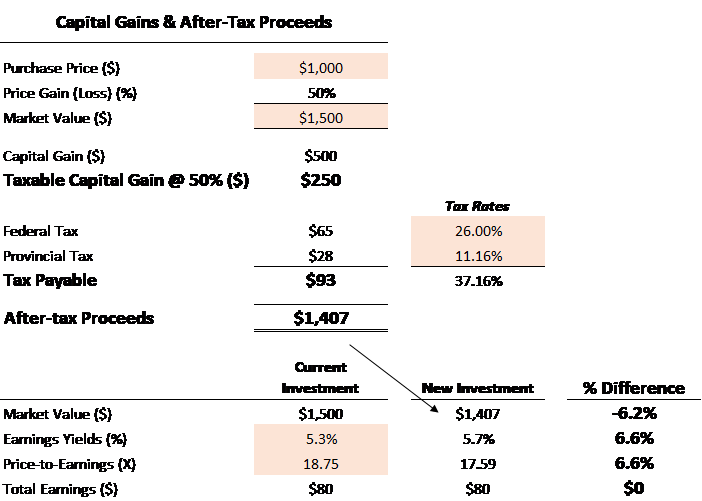

Our capital gains tax rates guide explains this in more detail. Senate Bill 557 enacted in November 2019 includes several tax changes. Long-term capital gains tax rates for 2019.

A year plus a day isnt really a long time for many investors but its the rule that lawmakers arbitrarily selected. You pay 127 at 10 tax rate for the next 1270 of your capital gains. PPR relief is.

The IRS typically allows you to exclude up to. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. There is currently a bill that if passed would increase the.

The IRS adjusted long-term capital gains tax brackets for inflation in 2020. Long-Term Capital Gains Taxes. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Capital Gain Tax Rates. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

As of January 2020 the standard deduction will increase by 75 percent for all filing statuses and market-based sourcing will be used to apportion income for purposes of calculating corporate income and franchise tax liability. PPR Relief last 9 months. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK.

Since 6th April 2020 if youre a UK resident and sell a piece of residential property in the UK you now have 30 days to let HMRC know and pay any tax thats owed. Ready or not tax return reporting has changed yet again for the 2020 tax season. 250000 of capital gains on real estate if youre single.

Capital Gains Tax Calculator For Relative Value Investing

Buy To Let Tax Changes In 2022 Capital Gains Tax Let It Be Buy To Let Mortgage

What You Need To Know About Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Biden Tax Plan And 2020 Year End Planning Opportunities How To Plan Tax Tax Brackets

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Tax Brackets Capital Gain

Capital Gains Tax Calculator For Relative Value Investing

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax What Is It When Do You Pay It

A New Way To Invest For The Vengeful And The High Minded Investing Capital Gains Tax Preschool Director

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)